Group Domestic Travel Policy – Terms & Conditions

Summary of Key Terms

This summary of key terms under the Group Domestic Travel Product Policy Terms & Conditions (“Policy”) is offered by Acko General Insurance Limited (“Acko”) to ANI Technologies Private Limited (“Ola”). Covers under the Policy can be availed by registered users/ customers on the Ola mobile application or any other online platform, owned and/or operated by Ola, including the One Travel Desk, (hereinafter referred to as “Ola App”) by selecting the option of ride insurance.

The insurance cover under the Policy will apply only to Ola trips which are booked through the Ola App. Insurance cover starts when customer’s Ola trip starts and cover ends when the Ola trip ends, up to a maximum period of 1 day for City Taxi and Ola Rentals, and 10 days for Ola Outstation.

Key Benefits:

Key benefits available under the Policy for the named rider and co-passengers travelling with the named rider on the same trip:

| Coverage up to | |||

| Benefits | City Taxi | Rental | Outstation |

| Accidental Medical Expense | Rs. 1,00,000 | Rs. 2,00,000 | Rs. 2,00,000 |

| Hospital Daily Allowance (Max 7 days) | Rs. 500/day | Rs. 750/day | Rs. 1000/day |

| OPD Treatment | Rs. 3,000 | Rs. 10,000 | Rs. 5,000 |

| Ambulance Transportation Cover & Evacuation (Medical and Catastrophe) | Rs. 10,000 | Rs. 10,000 | Rs. 10,000 |

| Accidental Death Benefit | Rs. 5,00,000 | Rs. 7,50,000 | Rs. 7,50,000 |

| Permanent Total Disability | Rs. 5,00,000 | Rs. 7,50,000 | Rs. 7,50,000 |

| Permanent Partial Disability | Rs. 5,00,000 | Rs. 7,50,000 | Rs. 7,50,000 |

| Repatriation of Mortal Remains | Rs. 10,000 | Rs. 10,000 | Rs. 10,000 |

| Missed Carrier (Covers Missed Flight Only (Domestic)*) | Rs. 5,000 | No | Rs. 7,500 |

| Loss of Baggage and Personal Effects & Electronic Equipment Cover(Laptop only) | No | No | Rs. 20,000 |

| Emergency Hotel Requirement | No | No | Rs. 10,000 |

| Home Insurance Cover & Fire and Allied Perils | No | No | Rs. 1,00,000 |

*Missed Flight cover starts when the customer books the Ola Trip and ends when the Ola trip ends, subject to the estimated time of arrival (ETA) at the airport of departure being before 60 mins of the scheduled departure time for City Taxi (other than Ola Share) and 90 mins before the scheduled departure time for Ola Share and Ola Outstation. This Benefit only covers domestic flights. Missed flight cover can be claimed only if the destination is specified as airport at the beginning of a ride. If the destination is changed to airport during the ride, ‘missed flight claims’ are not admissible. ETA to the destination can be checked on Ola Driver App.

General Conditions:

- If due to any technical reason the insurance for the ride is not fulfilled & premium is not deducted then it is invalid. Insurance is valid only if the premium is deducted for the same along with the ride fare

- The insurance will not be available for bookings made from Ola’s partner platforms or Ola Point. Partner platforms are platforms where customers can book Ola rides via a platform owned and/or operated by third-party partners. Example: Tapzo, Google Maps, etc.

- The claim will not be permissible in case the number of passengers (including driver) is more than the permitted seating capacity of the vehicle.

- Loss of Baggage and Home Insurance does not cover any Valuables, Money, Securities, Jewellery, Tickets and Electronic items (other than Laptop). It covers only for the loss of the items and not partial damage.

- The claim will not be permissible in case of wilful act of the insured, self-inflicted injury, mental illness, drug or alcohol abuse.

- The policy does not cover any contractual and consequential liability, except as covered in the Policy or this summary.

The following general exclusions as stated in the Policy will not apply to Ola or its customers:

- Any change of profession after inception of the Policy which results in the enhancement of the risk under the Policy, if not accepted and endorsed by Acko on the insurance certificate or insurance.

- Any event arising from or caused due to use, abuse or a consequence or influence of an abuse of any substance, intoxicant, drug, alcohol or hallucinogen.

- Any journey commenced to obtain medical care, treatment or advice of any kind whether this is the sole purpose of customers journey or not.

Claim & Documents:

Rider can file a claim for any of these coverages on Ola App, Acko Mobile App, Acko Website or Acko Contact number (18602662257) for registration of claim.

Rider needs to submit following documents in case of a claim:

- Hospital bills and discharge summary in case of medical treatments.

- Respective certificates in case of death or disability.

- FIR in case of loss of baggage or loss under home insurance.

- Missed flight confirmation from airline carrier in case of missed flight.

- Hotel Bills in case of Emergency Stay.

Claims Process on the Ola App:

- Choose the ride from ‘Your Rides’ for which you wish to raise a claim.

- Tap ‘Support’ from the bottom bar.

- Tap ‘Claim Insurance for this ride’ from the list of the issues.

- On next screen, tap on ‘Claim Insurance’ to create a claim.

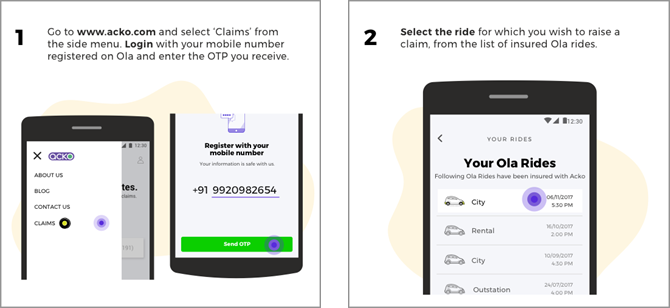

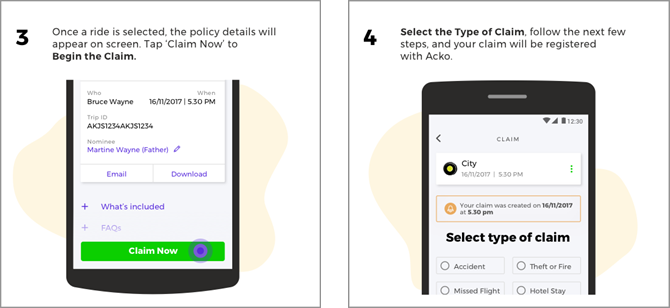

Claims Process on Acko website:

Please note that this is only a basic description of the key terms. Once you have opted for cover, you will receive a Certificate of Insurance from Acko which will contain complete details of your cover under the Policy. If you should require any further details on the scope of cover or terms and conditions, you can visit www.acko.com/ola/tc